Beautiful Thinking.

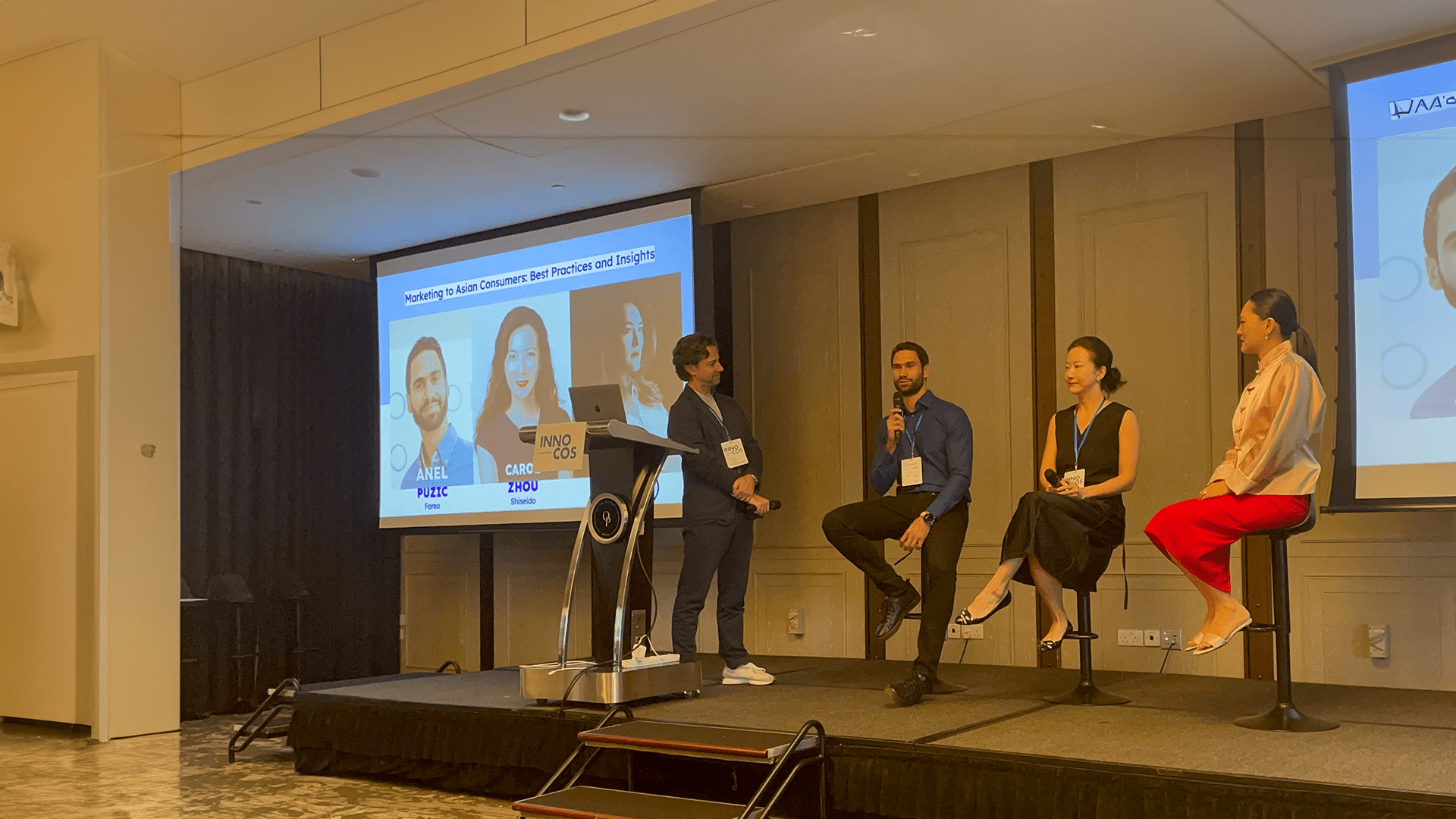

As part of this leading summit and it’s focus on the dynamic Asian market, Florasis’ Gabby Chen, Shiseido’s Carol Zhou, and Anel Puzic of FOREO, joined Nick to discuss how key factors including ageing populations, wellness trends, and technological advancements are shaping the beauty, wellness, and health landscape.

This year’s event explored this diverse, rich topic through the specific lens of longevity, and the consumer demand for this dominating trend that supports healthier, longer lives. Nick’s panel was a key moment during the event, with the panel discussion providing a masterclass in cultural nuance, consumer behaviour, and the future of beauty in a region marked by its diversity and innovation.

We take a look at some of the key highlights from these experts who shared their knowledge on navigating the fast-evolving beauty landscape across Asia.

The panelists unanimously highlighted the complexity of the Asian consumer base. Asia is not a monolith; its diversity demands tailored strategies for each region. Gabby Chen shared how Florasis’s success in China stemmed from its deep connection to Chinese culture, blending traditional aesthetics with modern products. However, expanding into Japan required a different approach, emphasising craftsmanship and quality—values deeply revered in Japanese culture.

Carol Zhou described the Asian consumer as aspirational yet deeply rooted in cultural norms. While older generations prioritise blending in with societal expectations, younger demographics, particularly China’s post-2000 generation, are embracing individuality and reshaping beauty standards. “In the West, it’s about standing out,” Carol noted, “but in Asia, beauty has traditionally been about fitting in.” This shift toward individuality presents new opportunities for brands.

China stood out as a focal point in the discussion, with its rapid pace of change revolutionising consumer behaviour. Gabby highlighted innovations like live-stream shopping and ultra-fast delivery, which have set new benchmarks for convenience and adaptability. “In China, business models change every six months,” she remarked, underscoring the need for agility in this dynamic market.

Carol described Chinese consumers as “early adopters,” eager to embrace cutting-edge technologies. This enthusiasm has turned China into a testing ground for global beauty innovation. However, as Anel noted, the speed of change also brings volatility, with many brands failing to build lasting loyalty.

The panel emphasised that China’s influence extends across the region. For instance, TikTok-driven shopping trends in Southeast Asia echo China’s e-commerce revolution. Brands expanding into markets like Vietnam, Thailand, and Indonesia must adapt these innovations while addressing local nuances.

One of the most compelling discussions revolved around cross-cultural expansion. Western brands often benefit from global prestige, but they face steep learning curves in adapting to Asian markets. Conversely, Asian brands entering the West must overcome stereotypes about “Made in China” quality while crafting narratives that resonate with Western audiences.

Gabby shared Florasis’s journey in reshaping perceptions of Chinese products. “Categories like EVs and tech have already shifted the narrative,” she said. “Beauty should be next.” Carol added that Japanese brands, such as Shiseido, have successfully blended cultural heritage with innovation, leveraging global admiration for Japanese craftsmanship.

The aging population in Asia emerged as a key demographic with immense potential. Consumers aged 40 to 50, equipped with high disposable incomes, are seeking premium, results-driven products. Unlike previous generations, they are unapologetic about investing in self-care.

Carol highlighted Shiseido’s ventures into medical beauty and ingestible supplements, which cater to this demographic’s desire for visible, immediate results. The shift from traditional anti-aging campaigns to empowerment-focused messaging reflects the evolving priorities of this consumer group.

Anel underscored the importance of cultural sensitivity, warning that even the best products can fail without the right marketing strategy. “If you misstep, you’ll die,” he cautioned. Aligning with values like harmony and modesty is essential for building trust and longevity in Asian markets.

Carol shared how Shiseido balances innovation with its Japanese roots, offering gender-neutral beauty and mindfulness-driven products while respecting cultural narratives. This approach exemplifies how brands can push boundaries without alienating their core audience.

Target Aging Demographics: The 40-50 age group represents a lucrative and under-tapped market.

The Innocos Beauty & Longevity Summit highlighted Asia’s role as both a challenge and an opportunity for global beauty brands. With its rapidly evolving trends and cultural diversity, Asia demands a nuanced approach to marketing. For brands willing to invest in understanding this multifaceted landscape, the rewards could be transformative. As Gabby Chen aptly concluded, “The future of beauty is not just in Asia—it’s global, and Asia is leading the way.”